Getting regulated by the FCA requires you to go through a fairly structured process all of which contribute to your application pack. These are abbreviated in the diagram below.

Diagram – Key FCA Application Stages

Do I need to be regulated?

The first thing to know is that all cryptoasset firms must be registered with the FCA under the Money Laundering Regulations (MLRs). However, the reason for this article is to help you determine whether your services fall within the FCA perimeter and require you to be regulated.

The first and a key stage to determining whether you need to be regulated is understanding your business model. It’s so important to have a clear idea of the products and services you want to offer, and the customers you want to offer them to.

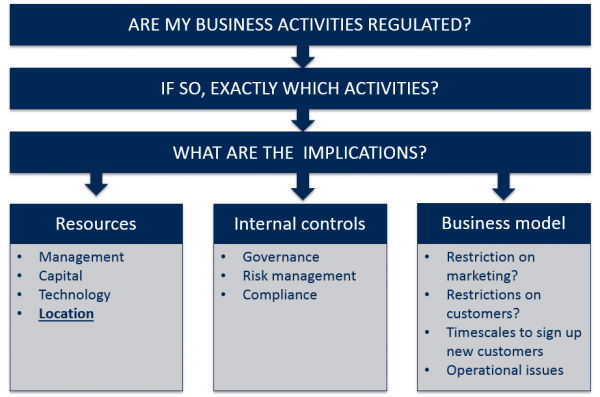

The question is then whether your business requires FCA regulation. If your business is out of scope you cannot become FCA regulated. You either fulfil the FCA perimeter definitions or you don’t. The FCA has a pretty clear view about what is within its perimeter and there are two main elements that firms have to consider:

- Does my business provide electronic money (e-money) and/or other payment services in fiat currency?

- Does my business perform investment activities (such as managing, dealing in or arranging investments) which are in scope as defined?

The trouble is this can be confusing and there are some grey areas. Let’s assume you decide you do need some kind of authorisation, i.e. some of your activities are deemed within the FCA perimeter. The first thing to decide is whether you actually have a reasonable chance of your application succeeding. Write a very short ‘preapplication business plan’. Take an honest, self-critical overview of your business, and assess the basics. For example, will you have enough regulatory capital to fulfil the minimum criteria? Is there anything else likely to derail the process, before you invest too heavily in the application and the supporting systems and controls? If there is, take steps to mitigate it before you start.

Key considerations

You will need to be crystal clear on your business activities. What exactly are you seeking authorisation for? Are you sure your activities won’t be covered by exemptions? If your application is approved it will determine the permission you receive from the FCA so it is very important to get this right upfront. Again, taking professional advice on this is sensible, as it is not always obvious what permissions are appropriate.

Next, are your owners and management team fit and proper to run your business? If your firm is not UK-owned, does it fulfil the so-called ‘mind and management’ test? Does your team have sufficient experience to run the business, manage it in compliance with the rules, and be completely accountable for its activities?

To assess this, the FCA will look at management’s previous experience in a regulated environment and similar business. People may need to be appointed into key roles (for example compliance officer or MLRO) and the FCA will question the experience, qualifications and training of those individuals. And they will assess management’s competence based on the aggregate skills of the team members, as well as each individual personally.

Finally you’ll need to do a detailed regulatory business plan. This will involve thinking through your business from an operational perspective. Who are your (potential) clients and how will you attract and retain them? What systems, controls processes, people and other resources will you need? Do you have sufficient finances to support your application and the required regulatory capital?

For such a critical process which could determine the success or failure of your business for years to come, it’s worth getting specialist advice. This can make all the difference to success or failure – and the time it takes to get authorised.